Google Search Console Impressions Down? Here's Why

In September 2025, Google's removal of &num=100 transformed how e-commerce brands interpret SEO metrics in GSC. Explore real case studies, quantified impression drops, and strategies to adjust your e-commerce SEO reporting.

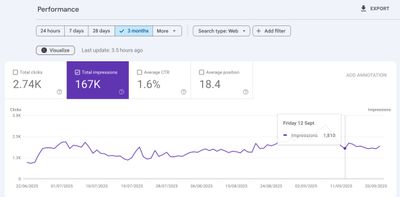

Noticing a sudden drop in impressions in Google Search Console (GSC) can be alarming. But not every drop is bad news. Here’s how to interpret the trend correctly and what actions to take.

Why Do My E-commerce GSC Graphs Look Broken? Understanding the Sudden Impression Drop

If you’ve been overseeing SEO for an online store, chances are that around September 2025 your Google Search Console (GSC) graphs took a confusing turn. Impressions dropped steeply, average positions appeared to improve, and CTRs spiked upwards. For many e-commerce owners and marketers—especially those managing thousands of SKUs who depend on steady organic reach—this shift looked like a disaster waiting to happen.

The surprising part? It wasn’t a penalty, nor was it a broad algorithm update aimed at e-commerce sites. Instead, it was triggered by a quiet yet highly significant reporting change: Google removed the &num=100 parameter. This setting had artificially inflated impressions for years by loading 100 search results per page, rather than the default 10.

This article explains what really happened, why it matters for your SEO reporting, and most importantly, how to adapt so your growth strategies remain accurate and reliable.

What Was &num=100 in Google Search and Why Did It Matter for E-commerce SEO?

For a long time, SEOs and rank-tracking tools leaned heavily on the &num=100 parameter. It instructed Google to show 100 search results per page instead of just 10. While this was convenient for crawlers—fewer clicks and faster data collection—it had an unintended side effect.

Google Search Console recorded impressions based on this expanded view. That meant if your product page sat buried on page 7 or 8, GSC still counted it as an “impression,” even though no real shopper was scrolling that far.

For e-commerce brands, this distortion had three major consequences:

- Inflated impressions: A store reporting 200,000 monthly impressions might actually have been hidden deep in positions 60–90, far from real customer eyes.

- Worse average position: Since low-ranking URLs were included in the math, average positions looked poorer than they really were.

- Suppressed CTR: With impressions artificially bloated, clicks stayed flat, which dragged CTR percentages down unfairly.

In short, &num=100 painted a picture of “visibility” that was more illusion than reality.

What Changed in Google Search Console in September 2025 and Why Did Impressions Collapse?

When Google silently removed the &num=100 parameter, it effectively stripped away this distortion. Overnight, e-commerce dashboards began to shift:

- Impressions fell: often by 30–60%. This didn’t reflect lost traffic, but rather the disappearance of phantom impressions from the depths of the SERPs.

- Average positions improved: those deep, irrelevant rankings were no longer skewing the data.

- CTR rose sharply: impressions dropped but clicks stayed consistent, offering a clearer view of engagement.

- Clicks remained stable: the key clue that customers were still arriving and converting as before.

For SEO managers, the graphs felt alarming, but the reality was simple—traffic didn’t collapse, measurement got corrected.

Why Did My Impressions Drop? Real Case Studies From E-commerce GSC Data

To illustrate the shift, here are anonymized case studies from six e-commerce businesses. Each compares impressions from 7 Sept (before the change) and 12 Sept (after the change).

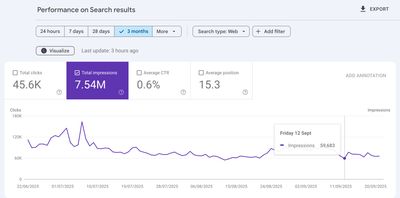

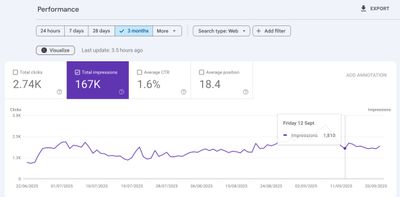

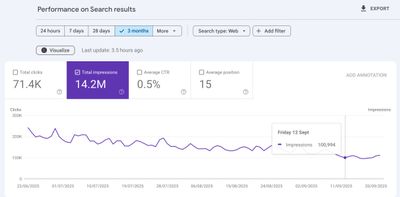

1 - Large Jewelry Retailer

7 Sept 2025 vs 12 Sept 2025

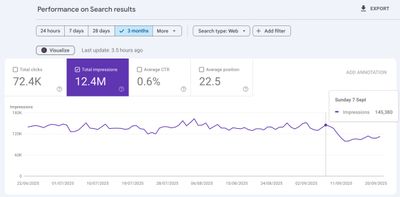

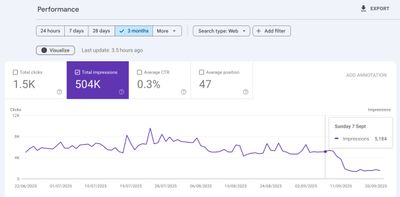

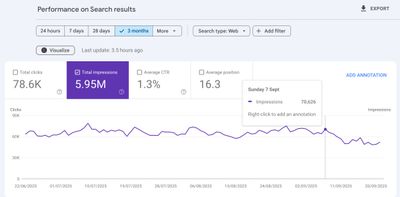

2 - Kidswear E-commerce Brand

7 Sept 2025 vs 12 Sept 2025

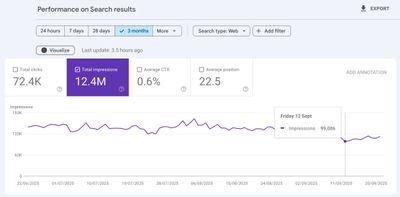

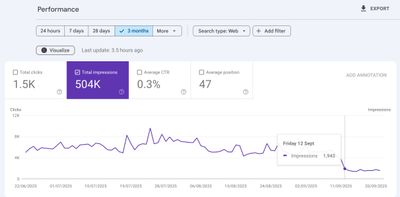

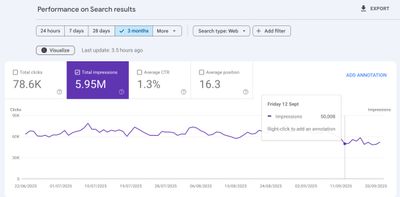

3 - Skincare & Beauty Brand

7 Sept 2025 vs 12 Sept 2025

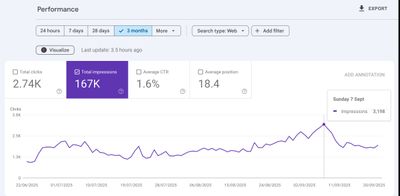

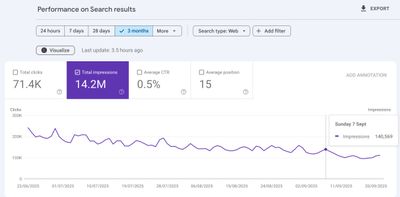

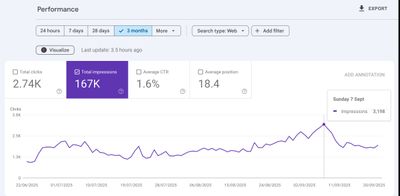

4 - Pet Supplies Brand

7 Sept 2025 vs 12 Sept 2025

5 - Outdoor & Sports Retailer

7 Sept 2025 vs 12 Sept 2025

6 - Kidswear E-commerce Brand

7 Sept 2025 vs 12 Sept 2025

Key takeaways

Across six e-commerce sites, impressions fell between ~28% and 63% from 7 → 12 Sept 2025 after Google refined how it reports total impressions, especially reducing counts from low-visibility surfaces. Rankings and clicks for core queries generally did not decline at the same rate. Treat this as a measurement change, not a demand drop; validate impact using clicks, CTR, and conversions.

What Problems Are E-commerce Brands Facing After the GSC &num=100 Change?

This sudden correction created genuine challenges:

- Stakeholder panic: Many leaders misread the graphs and assumed traffic had collapsed.

- Benchmarks invalidated: KPIs built around impressions became meaningless overnight.

- Forecasting breakdown: Sales models tied to impression counts became unreliable.

- Rank tracker costs: With 100-result pages gone, crawlers needed 10x more queries to cover the same ground.

- Confusing reports: Marketers had to explain why graphs looked worse while sales were steady.

Why Does the &num=100 Change Matter So Much for E-commerce Growth and Reporting?

Stepping back, the change is ultimately healthy — and highly practical for operators:

- Visibility you can bank on: Impressions now reflect where buyers actually look (page 1 pagination). Segment branded vs non‑branded and PLP vs PDP to understand true shelf space.

- CTR normalization: With phantom impressions gone, CTR stabilizes for page‑1 queries. You can finally compare CTR WoW/YoY without distortion and spot when snippets, image packs, or reviews move the needle.

- Position you can act on: Average position compresses to your real competitive set. Moves from 18 → 11 or 12 → 8 are now visible and prioritizable for “striking‑distance” SKUs and collections.

- Forecasting tied to revenue: Map rank buckets to session and revenue curves. Scenario plan: “+3 positions on top 50 SKUs” → predicted incremental revenue → content/tech investment cases.

- Cleaner executive reporting: Rebaseline dashboards post‑Sept 2025 and annotate the inflection. Fewer questions about scary graphs, more focus on SKU coverage, margin, and inventory‑aware growth.

- Tooling efficiency: Rank tracking budgets point at head and money terms, not deep pages. QA efforts shift to SERP features that actually drive clicks (stars, FAQs, images, video).

- Stronger growth loop: Teams move from vanity metrics to business KPIs: revenue per impression, revenue‑weighted visibility, and organic contribution to MER blended with paid.

- Better prioritization: Use GSC query x URL to surface cannibalization, consolidate thin PDPs, and strengthen canonical PLPs that can realistically win page 1.

Bottom line: less noise in GSC means clearer bets, tighter forecasts, and faster compounding growth.

How Should E-commerce Brands Adapt? A Practical SEO Playbook After the Impression Drop

Here’s how brands should respond:

- Re-baseline data: Annotate 12 Sept 2025 in GSC so sharp drops are correctly explained.

- Reset KPIs: Stop chasing impressions; instead measure clicks, conversions, and revenue per organic visitor.

- Educate stakeholders: Show side-by-side graphs proving clicks held steady.

- Segment smartly: Break results by branded vs. non-branded queries, and by page types.

- Prioritize page-one wins: Since true impressions come from top-10 results, invest efforts where it matters most.

This is the moment for e-commerce SEO to shift from vanity exposure to sales velocity.

What’s Next for E-commerce SEO Reporting After Google’s &num=100 Removal?

The path forward will bring:

- Rank trackers adapting to costlier deep-rank crawling.

- CTR benchmarks resetting to reflect cleaner engagement rates.

- AI-driven models producing sharper insights thanks to reduced noise.

- A mindset shift toward measuring SEO by business outcomes, not impressions.

Did Google Break My SEO? How to Move From Panic to Precision in Reporting

At first glance, Google’s removal of &num=100 looked catastrophic—graphs crashed, dashboards broke, and reporting pipelines faltered. But a deeper look reveals it wasn’t a traffic crisis at all. Instead, it was an overdue correction that delivered accuracy.

For e-commerce brands, this shift is an opportunity. By resetting benchmarks, guiding stakeholders, and tying SEO success directly to sales outcomes, businesses can emerge stronger.

The old era of inflated impressions is over. What remains is a clearer, truer picture of SEO performance—and with it, the chance to align strategies tightly with real customer behavior and revenue growth.

Want clarity after the GSC impressions drop?

Book a quick, free audit to separate real performance from sampling noise in GSC.

Article by

Sanjay Makasana

CEO at Webrex Studio

Scaling eCommerce brands to $1M-$100M ARR through Shopify optimization.